After an eventful move higher in MR (i.e. medium-range) product tanker rates in the first week following the February 5th European ban on Russia clean petroleum products, market participants watched with interest as LR (i.e. long-range) product tanker rates followed higher last week (13-17 February).

They also watched, in delight, while product tanker stocks moved precipitously higher:

In preparation for upcoming earnings reports from several more companies with product tanker exposure (Hafnia, Torm, Frontline) I thought it would be helpful to document LR rates changes since February 5th, and situate them in a broader context of recent historical averages.

One of the benchmark rates for clean (i.e. product) tankers is TC1, i.e. an LR2 route from the Middle Eastern Gulf to Japan.

Here are the rates from the last two weeks for an Eco vessel with scrubber:

Monday 6 February: $24,750/day

Tuesday 7 February: $33,750

Wednesday 8 February: $36,500

Thursday 9 February: $37,000

Friday 10 February: $36,750

—

Monday 13 February: $47,250/day

Tuesday 14 February: $46,750

Wednesday 15 February: $57,000

Thursday 16 February: $59,000

Friday 18 February: $63,000

Monday 20 February: $63,000

Tuesday 21 February: $69,000

So far in 2023, average TC1 earnings are $41,920/day.

In 2022, average TC1 earnings were $45,847/day.

In 2021, the average was… $10,794/day.

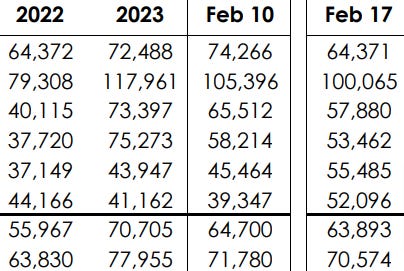

Let’s compare to Scorpio Tankers achieved rates from Q4 2022 and Q1 2023 guidance:

Scorpio owns and operates dozens of Eco LR’s, and their earnings performance is indicative of the broader market. Another large operator, Hafnia, will share earnings for the same period on 28 February 2023, which will allow for a useful apples-to-apples comparison. Frontline has a smaller but high quality LR fleet (i.e. Eco vessels which also command a premium), and will also declare earnings on 28 February 2023. Torm has an older fleet of LR’s; their earnings will be on 16 March 2023. This staggered calendar of earnings (along with Scorpio’s on 16 February 2023) will be useful in providing three snapshots of the market at different points in Q1, vis à vis LR rates guidance.

Let’s compare the strong TC1 rates (i.e. $43-$67,000/day) from last week with average Aframax earnings:

Aframax earnings have soared since the Russian invasion of Ukraine, and have put upwards pressure on LR rates, as many LR’s (including 7 of Frontline’s 18) are “trading dirty”, i.e. transporting crude oil to capitalize on strong crude oil transport rates. This artificially reduces the availability of LR’s “trading clean”.

Let’s look at another benchmark LR route, namely TC5, i.e. an LR1 route from the Middle Eastern Gulf to Japan (same route, slightly smaller vessel).

Here are the rates from the past two weeks for an Eco vessel with scrubber:

Monday 6 February: $27,000/day

Tuesday 7 February: $29,250/day

Wednesday 8 February: $28,750/day

Thursday 9 February: $30,000/day

Friday 10 February: $31,250/day

—

Monday 13 February: $31,250/day

Tuesday 14 February: $31,000/day

Wednesday 15 February: $34,000/day

Thursday 16 February: $46,000/day

Friday 18 February: $53,250/day

Monday 20 February: $53,250/day

Tuesday 21 February: $53,250/day

So far in 2023, average earnings on this route are $37,469/day.

In 2022, average TC5 earnings were $40,256/day.

In 2021, the average was $9,645/day.

Let’s contextualize with average LR1 and LR2 rates, going back to 2010:

The data set presented above is a bit misleading, as the starting year is 2010, the beginning of a decade-long bear market for oil tanker rates. But as you can see above, average LR rates tend to be between $10,000-$20,000/day, which further highlights how strong average rates have been in the past 12 months.

Another important factor is the break-even levels. i.e. At what point are these vessels profitable? Debt is a major factor input into break-even calculations. The good news is that because rates were so strong for so long in 2022, companies have been paying down debt more quickly, lowering break-even levels. And so good news begets more good news, and vessels become more and more profitable, the longer a bull market in freight rates continues.

During Q3 earnings, Frontline estimated LR2 break-even levels at $17,200/day. Scorpio mentioned $17,000/day as a fleetwide break-even number. Hafnia cites $15,000/day.

I would therefore characterize LR rates at different levels as follows:

* less than $17,000/day: not profitable

* $17-$20,000/day: barely profitable

* $20-$25,000/day: comfortably profitable

* $25-$30,000/day: unusually high, very profitable

* $30-$35,000/day: “Maybe we should talk about shareholder returns now?”

* $35-$40,000/day: “Did you buy call options? Buy call options.”

* $40-45,000/day: “I don’t see anything unreasonable about a Ferrari Monza as a company car, do you? I mean, this is Monaco.”

* more than $45,000/day: “Lars, I suggest we move this meeting to Le Bar Américain. Yes, I know it’s 10:30 AM. Look, it’s 5:30 PM in Singapore, ok?”

The reason I have spent this much time considering and documenting LR rates and profitability is because the crux of the product tanker thesis rests upon the idea that Russian clean petroleum products will be shipped further to new customers, and Russia’s FORMER biggest customer, Europe, will source its clean petroleum products from farther away. Both are thought to lead to higher LR utilization, and thus higher rates across the spectrum of product tankers.

Several companies has made some version of the following slide, meant to elucidate the magnitude of the trade disruption:

The Financial Times, in an article published today, wrote: “Clarksons expects the mileage per tonne of oil products to increase from less than 3,000 miles in 2020 to more than 3,500 miles in 2023 — up a sixth.”

Such estimates are useful as they give an idea of the scale of the disruption. But ultimately, higher rates for longer are necessary to prove that the thesis is playing out. Freight markets are notoriously volatile, and sentiment among traders tends to accentuate bullish and bearish trends. Although February has gotten off to a strong start, extrapolating too far into the future can be misleading… and dangerous.

Remember the first benchmark route I mentioned above, the LR2 route from the Middle East to Japan, or TC1? Let’s observe how rates evolved for an Eco, scrubber-equipped vessel from January 9th to the beginning of the embargo on February 5th, as a reminder of how things don’t always go according to plan:

Monday 9 January 2023: $73,250/day

Tuesday 10 January 2023: $78,500

Wednesday 11 January 2023: $74,500

Thursday 12 January 2023: $60,000

Friday 13 January 2023: $57,750/day

—

Monday 16 January 2023: $57,750/day

Tuesday 17 January 2023: $47,000

Wednesday 18 January 2023: $43,000

Thursday 19 January 2023: $47,000

Friday 20 January 2023: $46,500

—

Monday 23 January 2023: $38,500/day

Tuesday 24 January 2023: $37,250

Wednesday 25 January 2023: $34,000

Thursday 26 January 2023: $34,250

Friday 27 January 2023: $30,250

—

Monday 30 January 2023: $26,000/day

Tuesday 31 January 2023: $27,000

Wednesday 1 February 2023: $24,500

Thursday 2 February 2023: $24,500

Friday 3 February 2023: $24,750

(These above rate assessments are by Norwegian Infinity Shipbrokers)

Now, with the benefit of hindsight, we know that Europeans panic-bought as much Russian petroleum products as possible in November and December, only to taper off in mid January, well ahead of the arrival of February 5th. In the crude oil freight market, December 5th became a notorious “sell the news” event, in retrospect, and it seems that traders were anxious to “front-run” or anticipate the same type of market reaction, therefore selling off 2 weeks early.

But with product tanker freight rates climbing higher again, and sentiment buoyant, we need to evaluate if this rally is proof that product tanker freight rates will be “higher for longer", or whether this is yet another flash in the pan, a bullish trend to be thankful for… and faded.

I’d like to end with a song from Disney’s 2006 film “High School Musical”:

Thank you for impartial information and tradeable insights.

Tank you Edward, you write great articles.