Let me introduce you to the PSV: Platform Supply Vessels, a subset of offshore support vessels (OSV’s).

Most of you have never heard of PSV’s. They’re kind of like the pickup trucks of the open seas. That is willfully misleading, as it happens, because PSV’s are actually a lot more sophisticated than they look.

But more on that later. Let’s whet your appetite:

The above is from Wärtsilä’s maritime encyclopedia. In these photos, usually taken in good weather, one doesn’t get a full appreciation for the danger of offshore environments. The following quote helps to compensate:

The greatest dangers to a crewman working on a supply vessel include being washed overboard in bad weather conditions or being harmed — either by the cargo he is handling or by the equipment he is using.

How cheerful!

By now, you are wondering: “Why should I care about PSV’s?”

This is why:

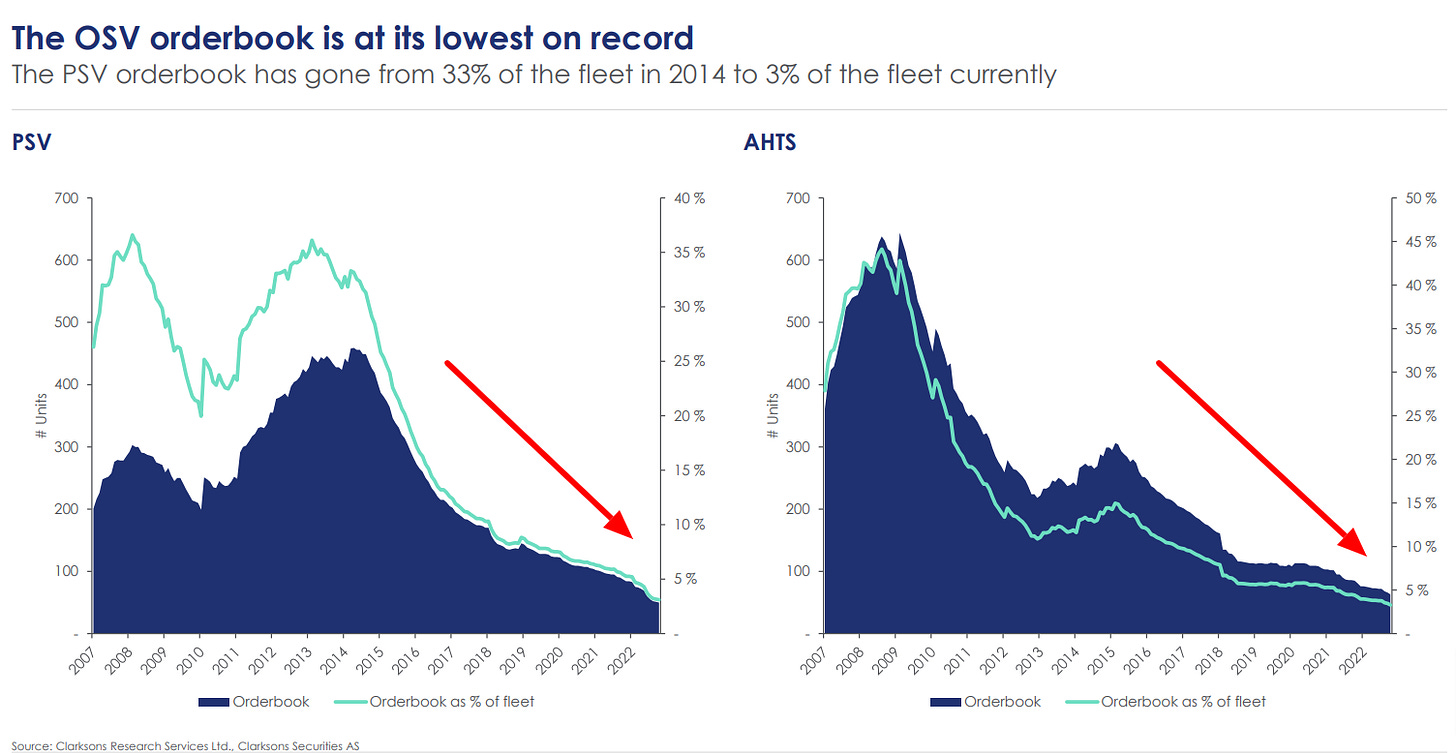

There are two fleets with truly low orderbooks. One of them is crude tankers.

The other one is — you guessed it.

I can tell you’re interested now.

Let’s look at the orderbook from a historical context:

Now let me show you what PSV charter rates are doing:

Part of the current market tightness comes from the fact that the offshore market has been so miserable in the past few years, leading to increased scrapping of vessels:

The recent frenetic period of scrapping is unusual because historically owners don’t bother scrapping PSV’s: the demolition value (sometimes just a few $100,000’s) is paltry compared to resale value. It usually makes more sense to keep vessels “stacked” — effectively in storage — until the market improves.

These fleet and orderbook characteristics are probably why Maritime Strategies International recently highlighted offshore vessels as the most attractive risk/reward in shipping over the next 4 years:

The demand side — while robust — is a complex subject to map, so at this stage I will only give an overview with a map of the territories which drive demand. South America and West Africa loom large, as two of the most active territories in offshore oil and gas exploration:

Perhaps the most exciting feature of the offshore vessel market is that demand is driven by offshore oil and gas investments… but also offshore wind. So a bet on OSV’s is not just a bet on fossil fuels but on renewables too:

Now you’re wondering: “Which stonks!”

SMHI looks interesting. Higher fin leverage than TDW for example but also more conservative on how they expense maintenance capex/dockings. Cld mean CF numbers are possibly more reliable. Looking at vessels at work it's possible they're about to turn the corner on net pft, share price hasnt rerated much vs some. on P/B looks like c0.6X. Opp to buy a fairly modern fleet at pretty distressed valuation levels still.

Cliffhanger!