This is the first in a series for investors new to offshore vessels.

The idea: it’s a list of important things no one will tell you.

So I’m telling you.

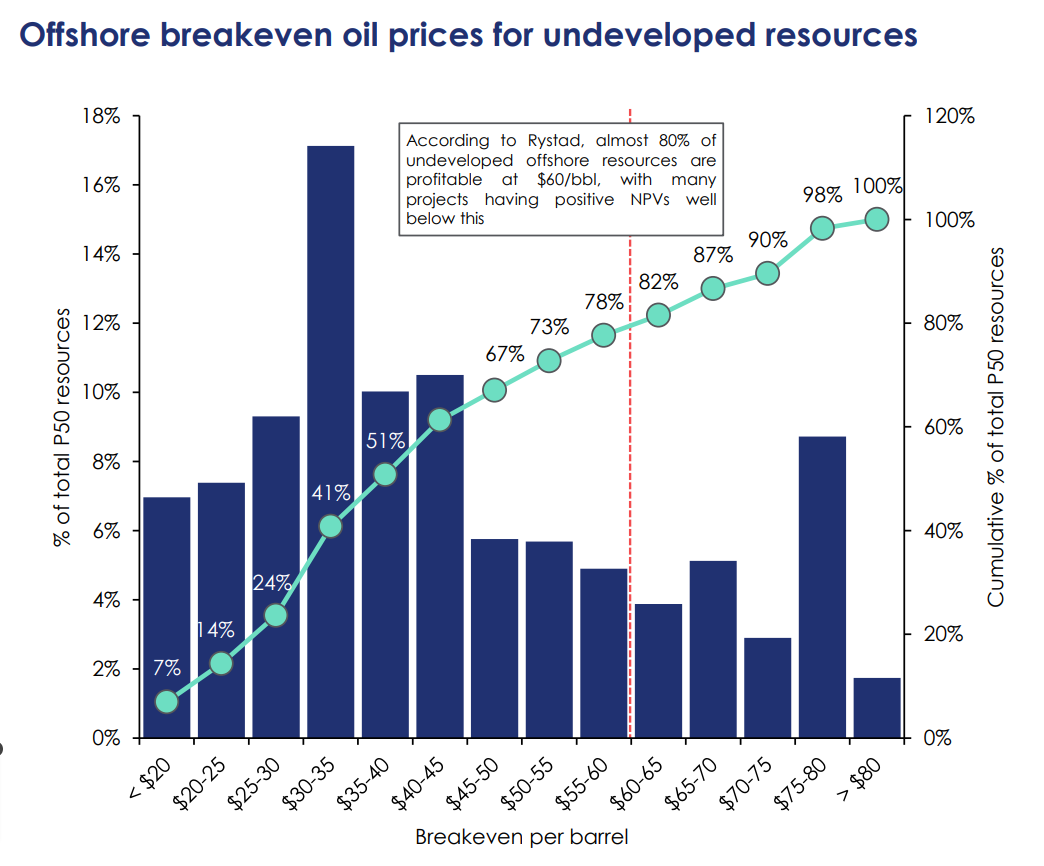

~80% of undeveloped offshore resources are profitable at $60/barrel

During previous offshore cycles, the North Sea had among the highest OSV dayrates. Since the last offshore meltdown (2014-15ish), North Sea dayrates have lagged most other areas (US Gulf, Latin America, West Africa, SE Asia)

The hangover from the last offshore party was so bad, that tons of rigs and vessels were ordered by cos which went bankrupt… and only NOW are they being bid on and reactivated / finished / delivered to new owners

If you want a proxy for offshore vessel demand, look at offshore rig count. rig count going up = good. Deepwater & ultradeep water going up = extra good

Anchor Handler Tug Supply (AHTS) vessel rates are wildly volatile. They are like VLCC’s: when times are good, the spikes are extremely profitable, but the spikes tend to be short-lived.

Offshore rig contracting is the highest it has been in 10 years (for both floaters and jackups)

Offshore support vessel rates tend to remain in a “clearly higher than average” range OR “clearly lower than average” range — for years at a time. One broker says it this way: there is no such thing as an average rate.

Utilization is king. It is trivially easy to track how many working vessels there are in each individual territory. And when availability runs out, rates do fun things.

Offshore vessel rates are opaque. Even when companies publish press releases to brag about new multiyear contracts, they won’t share the dayrate. So people working in the industry with access to that information have an asymmetric advantage (…or people who subscribe to this blog ;) )

Brazil drives Latin America’s offshore supply vessel market. Many of its offshore fields are deepwater, which require more support vessel capacity — and bigger vessels. The Brazilian market is protectionist and a vessel coming from somewhere else can only work there if it can prove it is not taking the work away from a Brazilian-flagged vessel

Every offshore cycle ends with an orderbook > 30% of the fleet. The orderbook is currently at 2%. There were several recent years during which not a single PSV vessel was delivered. [edit: a friend mentioned Golden Offshore’s “Energy Duchess and Energy Empress” both built in 2019]

Platform supply vessels were so unpopular in recent years that people had them converted into superyachts. I’m not joking:

A growing offshore market not many sources mention is the Mediterranean, which is increasingly focused on gas. Two of the active countries are Israel and Egypt. Israel has already shut down one of its offshore gas fields (Tamar) because of the war. The larger one, Leviathan, remains open for now. It is unclear how the war will affect ongoing gas drilling projects in Egypt and other neighboring countries such as Turkey.

Dry docking is a MUCH bigger expense for offshore vessels as a % of the asset’s value, than in other shipping segments (tankers, dry bulk, containers, LNG carriers, etc). For example, an older medium-sized PSV might be worth $10 million, but its special survey can cost as much as $1.5-$2m.

Paradoxically, the Middle East is not a great market for offshore vessel owners, because a lot of the exploration happens in shallow waters, so they don’t need as many vessels, or vessels which are as big. Rates there are poor and the clients have the reputation of being difficult.

Is this helpful? Let me know in the comments. I’ll do more.

And remember to subscribe!

A friend wrote in and asked: “So – you don’t like the GEOS owned “Energy Duchess” and “Energy Empress”? Both built in 2019, 850 m² deck size”

That’s what friends are for!

Hat tip for the Colombo meme.

I think that yacht owner just wanted a vessel that looks like the Disco Volante in Thunderball.