I’ve been working on the North Sea Platform Supply Vessel market, and put together this mosaic of info, to give you a feel for how the market is evolving.

I’ve had requests to open up the blog from time to time, to show what subscribers have access to, so here you go! Enjoy.

— Ed

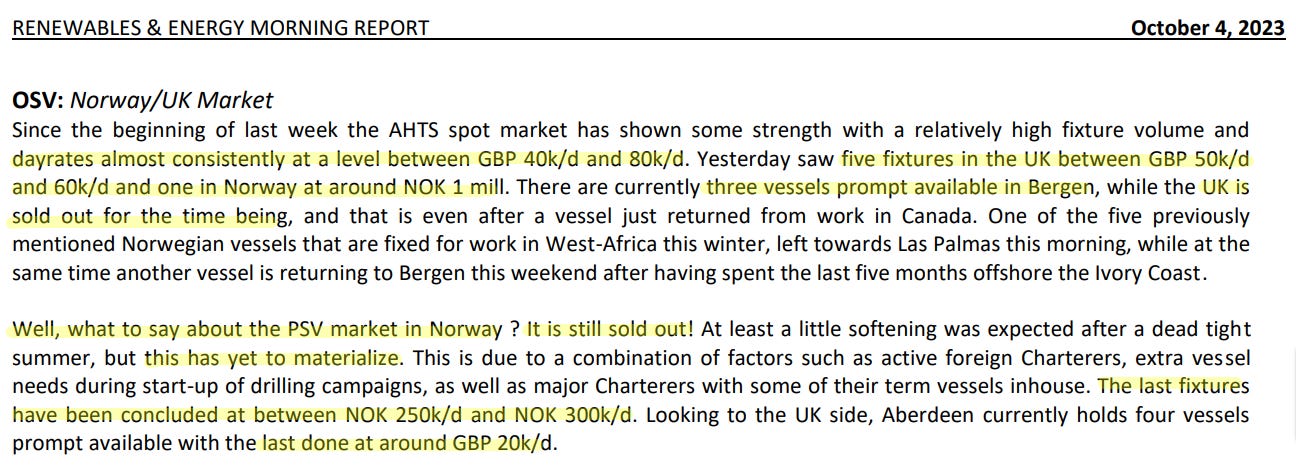

First, some color on the North Sea AHTS market by Seabrokers:

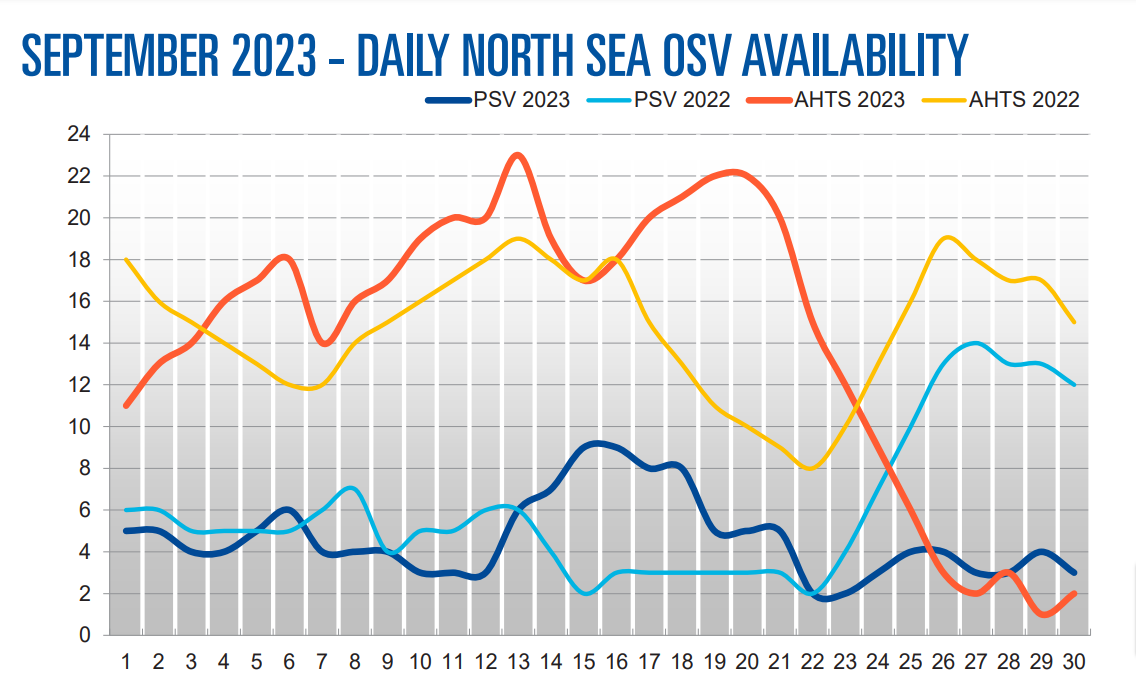

September proved just how fickle the North Sea AHTS market can be. The first half of the month was extremely slow for vessel owners, with plentiful availability and rates primarily in charterers’ favor. There were some days where more than 20 vessels were prompt available for charter throughout the region. During the first couple of weeks of September, owners struggled to achieve more than £25,000 or NOK 250,000 for a spot AHTS fixture.

As the month progressed, the market momentum shifted dramatically. A steady flow of rig moves materialized in quick succession (…) Towards the end of September, there were spells where all Norwegian and UK ports were completely sold out of AHTS vessels, and availability was limited to a small number of vessels trading out of Rotterdam. During the second half of the month spot rates [reached] as high as £80,000 or NOK 1 million.

Glancing at offshore fixtures via Marhelm’s database, it is clear that AHTS rates spiked during the last 10 days of the month:

I was also intrigued by this announcement of a 5 year (!) contract extension for the PSV Polaryssel starting 1 January 2026. Reader Lars Kallum commented to share that the rate is NOK 233,000/day, an amazing rate considering the duration: “The vessel has been hired by the Governor of Svalbard for 6 months per year since 2014, and 12 months per year since 2023.” Details here. I’m always interested in multi-year PSV contracts because they help determine asset valuations.

Something else I have noticed in the North Sea market is the increased mentions of hybrid battery power systems for offshore vessels. It’s like the Toyota Prius of PSV’s:

A hybrid battery power system for offshore vessels is just a combination of a traditional diesel engine and a battery pack. The system works by using the battery pack to power the vessel during low-load operations, like when it is idling or operating at low speeds. This allows the diesel engine to run at its optimal load, which saves fuel and reduces emissions.

Hybrid battery systems can also be used for peak power for short periods, like when the vessel is accelerating or operating in dynamic positioning mode [more on this in a separate article]. The use of the battery can help reduce wear and tear on the diesel engine, extending its lifespan.

Oil majors like using offshore vessels with hybrid batteries for their ESG credentials, especially in the North Sea (in West Africa they are… less concerned with such luxuries). As an example, EQNR 0.00%↑ recently resumed a contract with Skansi Offshore’s Kongsborg PSV vessel (built 2013, 1002 m²), following her 10 year survey and installation of a hybrid battery system. The vessel is contracted to Equinor until Q4 2025, i.e. another 2 years. I’m told the rate is “230-240,000 NOK-ish” per day.

Just for fun, here is the list of the vessel’s cargo capacity by category:

Perhaps the biggest news for the North Sea offshore vessel market isn’t happening in the North Sea at all: it’s happening in Brazil.

Charterers around the globe look on anxiously to gauge whether PBR 0.00%↑ might start poaching vessels from other regions to facilitate its extensive fleet requirements. While Petrobras has already been extremely active on the tendering front over the last 6-12 months, the latest exercise has seen the charterer approach the market with a tender requesting the provision of as many as 20 PSVs for contracts commencing in the first half of 2024. Significantly, both Brazilian and foreign-flagged tonnage can be offered for the spread of contract opportunities [via Seabrokers].

This is especially notable because Brazilian regulations are infamously strict and costly (vessels need to be registered with the Brazilian Maritime Authority, incurring sizeable admin fees, crews need to speak Portuguese…) so if they are explicitly welcoming foreign-flagged tonnage it means they want to make the market more competitive, which could lure vessels away from the North Sea. After all, despite the expense involved of moving and registering the tonnage in Brazil, the rates are FAR higher there:

Note: North Sea rates are in British Pounds, i.e. £19,000 is $23,000. Still, earnings in Brazil are +60% higher for large PSV’s, and several companies with North Sea tonnage have signaled that they are putting in offers for Petrobras’s tender.

Here you can see a visual representation of how stronger markets in the US Gulf, Brazil, and West Africa “pull up” North Sea PSV rates:

Petrobras is offering four-year firm charters with starting dates of February or May 2024. PBR included a “guidance budget” of $26,000 — $44,000 for PSVs depending on vessel specs and the scope of the work.

For context: if you are the owner of a high-spec PSV in Norway or the UK, the chances of you getting $40,000/day for a 4 year (!) contract are…zero. If you got half that you would be lucky.

The Brazilian “pull” should benefit PSV rates in the North Sea, as supply dwindles:

When examining trends in both AHTS and PSV availability in the North Sea, it’s intriguing to note the unexpected drop in AHTS, and the persistently low levels of PSV availability too. The contrast with 2022 is instructive:

The year over year comparison is even more striking when comparing rates:

The question on everyone’s mind is: to what extent will seasonality play a role in such a tight market? Look at the delta between September 2022 and 2023 for PSV rates:

The AHTS y/y change:

As I’m working on this article, this just appeared from Fearnley’s:

This AM, GS downgrades Maersk to a SELL.

Like they just discovered container carriers are in a downdraft?

Seems like a CYA note.

Thank you Edward, very relevant. Glad to read Petrobras's management is pragmatic. Allways looking for clues .