10 Charts

Chart porn to celebrate US Independence Day.

Below are 10 notable charts from my inbox.

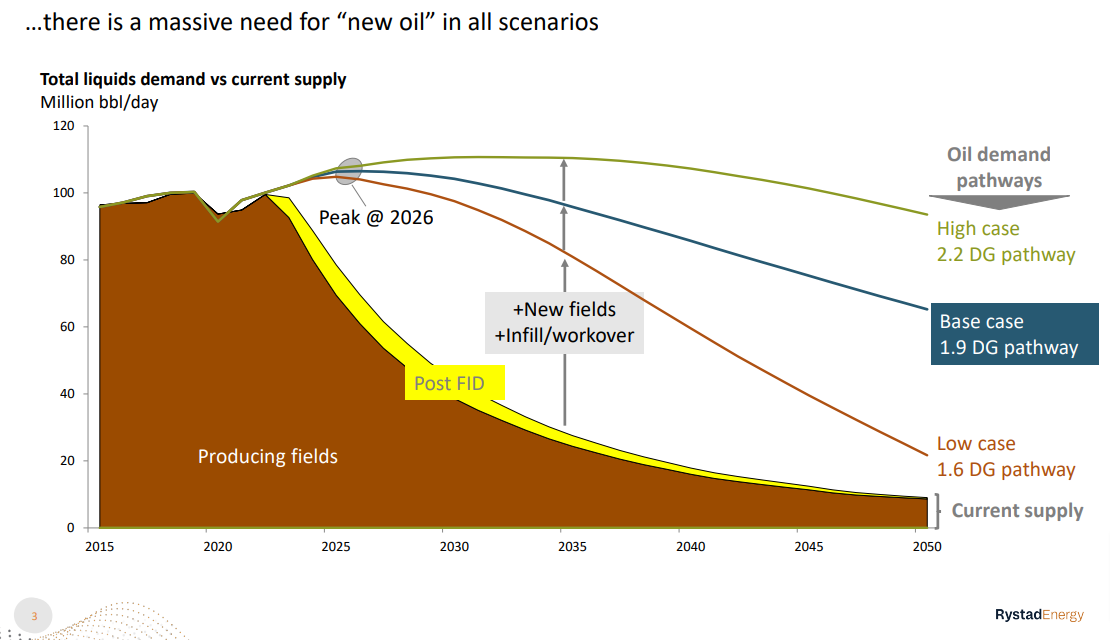

The case for offshore oil exploration, in one chart:

Crude oil tanker orderbook to fleet ratios, in historical context:

Supramax asset values versus 1 year TC, via Fearnley’s:

West African crude was expected to replace Russian crude post EU embargo, but in fact the Americas have been the big winner:

Have tanker S&P asset values peaked? via Clarkson’s:

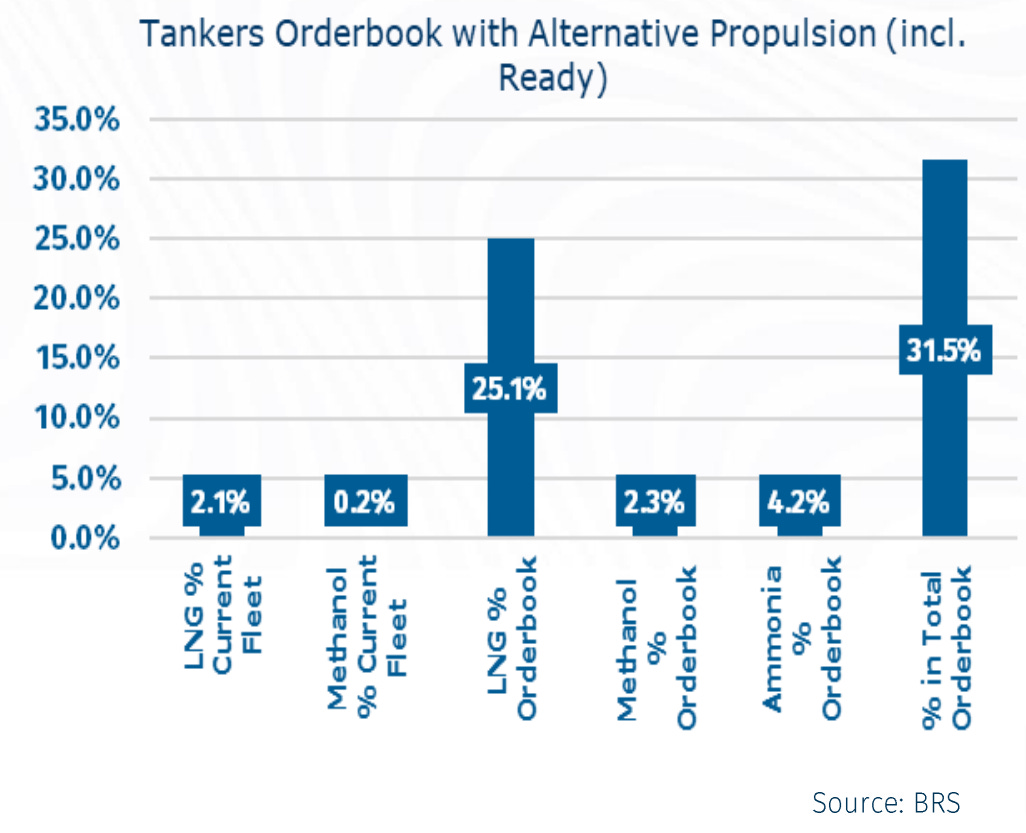

Most tanker owners are not prepared to order dual-fuel newbuilds, via BRS:

VLCC spot rates remain remarkably buoyant so far in Q3, via Arctic:

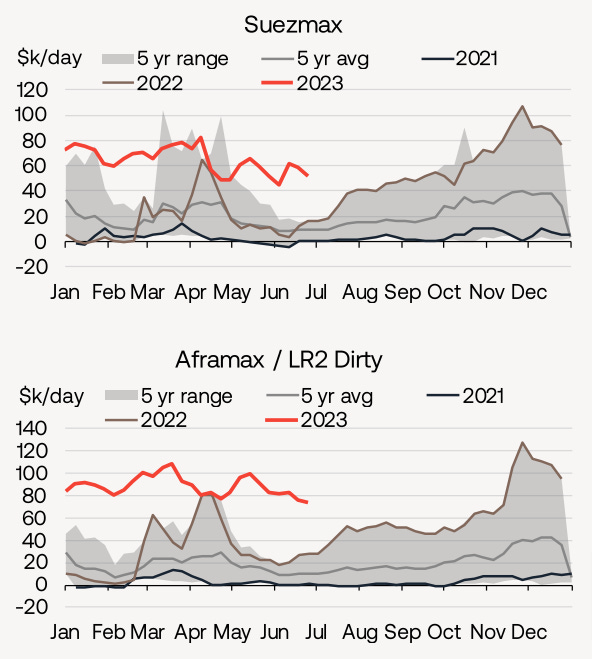

Still, it’s Suezmax and Aframax tankers which have benefitted the most from the “war premium” following the invasion of Ukraine, via Braemar:

We are trading near “average” valuation levels, even in an exceptional freight environment, via Stifel:

Scrubber premiums have come down. But with cheaper bunker costs ALL vessels are more profitable. via Clarkson’s:

[EDIT] One more chart just in from S&P Global, which I’ve added to illustrate that as the Russian premium disappears from freight, the Urals discount does too:

Happy Fourth of July. If this is helpful, I’ll do it more often.

high quality charts. Thanks!

Very interesting , particularly the off shore oil exploration one . Much appreciated , many thanks .